Turning Your Portfolio Into a Force for Good (and Growth)

Futureproof gives you real-time ESG insights across your portfolio, automating data collection, improving performance, and helping your companies stay compliant.

%20(1920%20x%201080%20px)%20(1400%20x%201050%20px).jpg)

Trusted by leading private equity firms and their portfolios

How it works

- 1.

We onboard your portfolio companies

- 2.

They use Futureproof to input data, track metrics, and report

- 3.

You get a clear portfolio-wide view, and stronger ESG outcomes

Proof it works

See exactly how Futureproof works for consultants

Start free and get access to:

- A fully featured test account (play with real workflows, nothing locked)

- Bulk upload tools & automated emissions mapping

- Instant report generation

- Unlimited expert guidance during your trial

Flexible ways to work with us:

1) Futureproof-branded platform – £200/month per consultant client

2) White label – Your brand front and centre (20% of client fee goes to Futureproof)

GET IN TOUCH →

We build investor-grade ESG foundations across PE portfolios

Measure ESG data (without extra hires or tools)

Futureproof captures everything, carbon, supplier data, employee surveys, all in one platform. No need to hire ESG teams or juggle multiple tools.

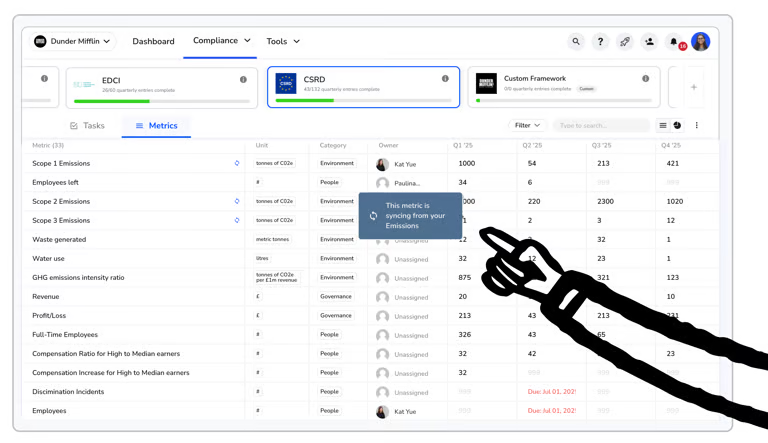

Report to any regulation with ease

Whether it’s CSRD, SECR, or GRI, Futureproof automatically aligns your data to the right frameworks so reporting is effortless.

Improve ESG performance and achieve B Corp

Turn insights into action. Benchmark, track improvements, and align with leading frameworks like B Corp, proven to drive stronger impact and up to 1.2× higher valuations at exit.

Demonstrate portfolio-wide progress

Your portfolio can easily report back to you, giving your PE firm a unified view of ESG metrics, performance, and reports, all in one place.

.png)

Used by teams who care.

ESG & Carbon Baselines

Standardised, verifiable carbon footprints across your portfolio.

Regulatory Readiness

Prepped for CSRD, SFDR, SECR and more — without custom projects.

Dashboards & Live Metrics

Clear, centralised reporting that you and your companies can act on.

LP & Board Reporting

Investor-grade exports in seconds, structured, visual, and credible.

ESG Action Plans

Assign tasks, set deadlines, and track impact across your companies.

.avif)

Got portfolio companies exploring

ESG or B Corp?

Click here

Tyk

Tyk | Building investor-grade ESG foundations at scale

As a PE-backed global tech scaleup, Tyk faced growing ESG expectations from investors and mounting internal complexity across markets. With Futureproof, they turned ESG from an overwhelming checklist into a clear, actionable strategy. Together, we built the systems, data, and roadmap that investors, and teams, could actually use.

Highlights

- Full carbon baseline mapped across multiple markets

- Simplified supplier ESG data from vendors like Google, Amazon & Meta into one export

- 100+ ESG tasks completed from a strategic roadmap aligned to investor reporting needs

- Preliminary B Corp score: 84.2

- Ranked #56 in the UK’s Top 100 Best Places to Work for wellbeing

FAQs

Start the conversation

No sales pitches, let's see what you need and if we're the right people to help you.

.svg)

.svg)